IT Mega Projects in Banking 5/2013

Summary

75 percent of all IT Mega Projects of banks do not reach their goals, 25 percent are cancelled even unsuccessful. Unrealistic objectives, underestimated complexity of the underlying IT landscape and overestimation of one’s own capabilities are the main reasons for failure. Completely different ideas of all stakeholders about the goals of the project are early warning signs. A common strategy is one of more than 22 success factors from which one can learn for future IT Mega Projects.

Failed IT Mega Projects

Allied Irish Bank has sued Oracle over a failed, Euro 84 million core banking system implementation.

In Switzerland, the 500 million francs expensive IT Mega Project "A Risk" of UBS has so far led to no results. The risk positions are still calculated and consolidated with Excel sheets.

The Japanese Mizuho Bank has lost more than 1.8 billion yen and its hitherto high reputation in 2002. This was caused by a faulty technical integration of three payment systems that crippled almost the entire Japanese monetary transactions. More than six months, there were violent disturbances regarding money transfers, credit card transactions and when customers tried to draw money from the ATMs.

And the IT transformation of the Commonwealth Bank of Australia based on SAP has engulfed more than 1.1 billion dollars in 5 years - plans were Dollar 580 million.

My analysis of more than 150 IT Mega Projects in banks has revealed that 25% of all IT Mega Projects failed with no results, 50% failed to achieve the project goals and only 25% were successful.

Understand causes for failure

As main reasons I have identified a strong underestimation of the high complexity of the underlying IT landscape, often politically motivated, unrealistic project goals, overestimation of one’s own capabilities and an exaggerated optimism.

In addition, there is clear evidence that IT Mega Projects in banks are often viewed as unique. Therefore, senior managers and project managers of the banks, IT service providers and consultants often make no effort to learn from similar past IT Mega Projects.

At this point, my approach is to improve the preparation and implementation of IT Mega Projects in banks. This involves developing a better understanding of the fundamentals, to avoid already known mistakes, to determine success factors, and to identify early warning signs.

For example, many IT Mega Projects suffer from the very different ideas of the project objectives by the stakeholders and project members. Thus, for example, the bank’s product management focuses on the specification of new banking products and banking services while the IT department looks at a 1:1 replacement of the old system as the highest priority. As a consequence the IT department migrates products "only" from a technical perspective, and product management insufficiently tests the accuracy of the technical product migration. These different objectives are often only discovered in integration test. At a time the project migrates the existing products to the new core banking system. Too late false savings and credit products, balances, terms and interests rates are found in the new system.

Approach to improve

Consequently, it is important to avoid that project members of an IT Mega Project have different project objectives. Or positively formulated: A "common strategy" is to be sought:

„ Strategy, objectives and scope are widely shared

and changes are managed well by all stakeholders

and project members.“

For example, the common strategy was one of the key success factors of IT transformation of Dutch Friesland Bank. Within two and a half years, the bank was able to successfully migrate all accounts, deposits and payments on a new core banking system.

From more than 150 IT Mega Projects in banks, I have been able to identify more than 22 such success factors.

The business models of banks usually differ greatly from one another. Some banks have more than 10,000 customers, others more than 10 million. Many banks are active only regional, some global. And others make their money with wealthy private clients while some are specialized in lending to industrial and corporate clients.

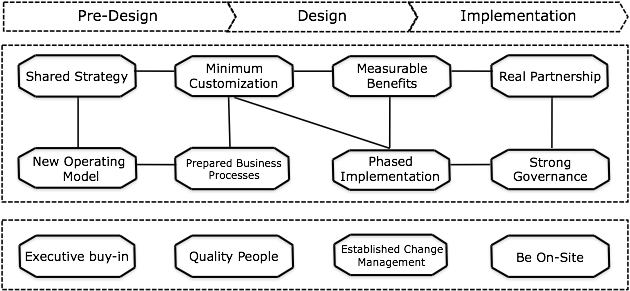

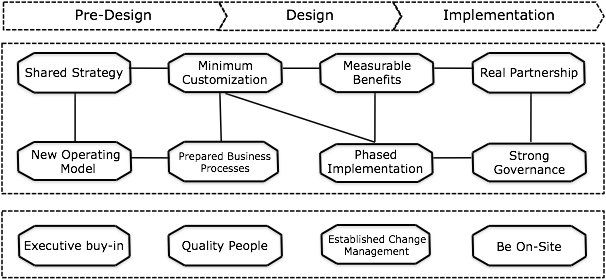

Thus, for each IT Mega Project it is necessary to adapt the relevant success factors accordingly. The following figure shows an example of such a framework built specifically for a core banking transformation of a bank:

With sufficient planning and qualified, experienced project members, on the one hand, ready to learn from past projects and on the other hand open enough to engage in the particular new situation, banks increase their chances to implement their IT Mega Projects more successfully.

Links

http://www.youtube.com/watch?v=P-s4ke62iy8, 90 seconds trailer of my 90 minutes presentaion about „IT Mega Projects in Banking“ (in German)

https://www.facebook.com/OxfordBTC?fref=ts, Oxford's BT Centre for Major Programme Management

http://www.sbs.ox.ac.uk/research/people/Pages/BentFlyvbjerg.aspx, Bent Flyvbjerg is Professor and Chair of Major Programme Management at Oxford University. He works for better management of megaprojects and cities.