Summary

In order to deliver great customer experience banks need to renew their core banking systems first. A core banking system is the most critical system of any bank. Over the last 15 years the core banking system packages of IT vendors did mature significantly. In 2015 we will see the peak of core banking system implementations. It is of vital interest to banks to have an understanding of the performance of these systems. In July and August 2011 I have asked more than 130 core banking system experts, globally about their experience with core banking systems packages. The survey provides clear differences between the core banking system packages.

Drivers of change

Ovum estimates that the annual IT spend of banks on retail banking technologies will grow to 132 billion US $ by 2015 from 120 billion US $ in 2010. Major drivers of the increase of IT spend are:

-

1.Changing customer behaviour

-

2.Decrease of margins

-

3.Increase of regulatory requirements

-

4.Legacy technology

Most banks still operate their IT landscapes with 30+ years old legacy core banking systems. From my experience inflexibility, redundancy and technology variety of the legacy core banking systems of banks are major causes for the inability of banks to deliver great customer experience at the point of sale. The legacy core banking systems cause also the limitations of being highly productive with respect to bank service delivery. Therefore banks need to transform and renew their core banking systems first.

Critical core banking system

There are various definitions of core banking systems. For me a core banking system takes care of the following three core functions of a bank: accounts, customer data and payments. Any customer interaction, any bank transaction and any bank business is related to at least one of the three functions. And if one of the three functions does not work the whole bank production needs to be stopped.

For example, if a loan system fails for a week a bank may suffer significant losses in revenue, reputation or customer loyalty. But if the account system fails for a week the bank will not be able to handle credits and debits anymore and the bank will go bankruptcy because of technical insolvency. My bet is that this will happen to a bank within the next five years given the number of 30+ years old core banking systems out there.

The rise of core banking systems of IT vendors

Core banking systems of IT vendors did mature over the last 15 years. Today less and less banks decide to further develop their core banking systems by themselves. Instead, banks consider vendor core banking systems as serious alternatives.

Since 2005 we see a constantly growing number of core banking system implementations, globally. I personally expect a further increase of core banking system implementations until 2015. Once the peak is reached I expect a decrease until 2025.

Core banking system survey

There are thousands of self-developed core banking systems and hundreds of local IT vendors who offer core banking systems. Given the importance of the core banking system of any bank and the rise of core banking systems of IT vendors it is of vital interest to banks to have an understanding of the performance of these systems.

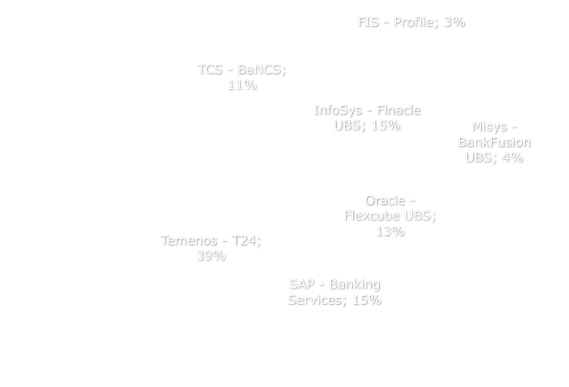

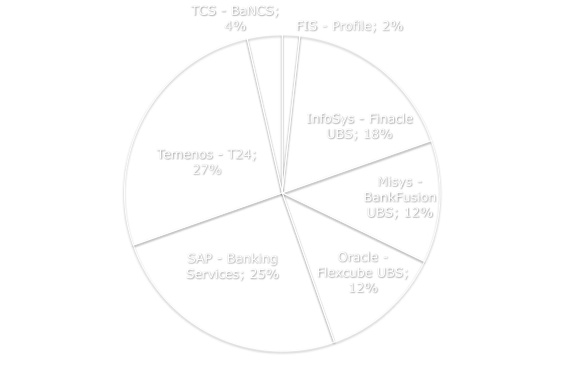

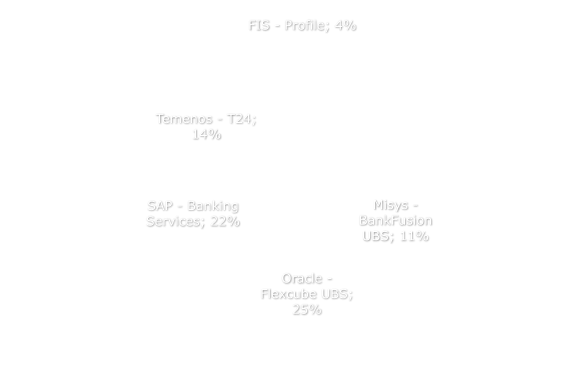

In July and August 2011 I have asked more than 130 core banking system experts, globally about their experience with the following core banking systems packages:

-

✦FIS – Profile

-

✦InfoSys - Finacle UBS

-

✦Misys - BankFusion UBS

-

✦Oracle - Flexcube UBS

-

✦SAP - Banking Services

-

✦Temenos - T24

-

✦TCS – BaNCS

Taken into account that there is not a single person who has full transparency, experience and insight regarding all core banking system packages, the survey still provides some important insight and clear indications into the differences of the several core banking system packages. The survey results reflect mainly my personal experiences, as well.

Enclosed an excerpt of the core banking system survey results.

-

1.Which core banking system has the broadest functional coverage?

-

2. Which core banking system is the technically most advanced system?

-

3.Which core banking system is the most secure one?

The survey did not consider strategy, scope, size, region and further critical factors. All factors are important to choose the appropriate core banking system for a specific bank in a specific environment.

From my experience, while the right choice of a core banking system is important the bigger challenge is the approach towards its implementation.