Mobile Banking Strategy 2/2012

Summary

A banking app for the iPhone alone does not make a mobile banking strategy of a bank. Using open innovation approaches and new technologies, banks can develop and implement a sustainable mobile banking strategy. The example of the Commonwealth Bank of Australia shows how modern banks involve their most creative customers to create the future of banking. It also shows how mobile banking is implemented as part of a comprehensive Customer Touch Point strategy. Meanwhile, there are first innovative providers of advanced mobile banking IT platforms, such as Market Simplified. These platforms help to create mobile services beyond online banking and to master the diversity of mobile devices.

Strategic weaknesses of current mobile banking strategies

Mobile banking apps studies such as of MyPrivateBanking and of the Frankfurt School of Finance & Management disclose some strategic weaknesses in the offers of banks. In essence, one can identify four weaknesses:

-

1.Many banks limit the mobile banking offering to less informative, basic services such as account overview, money transfer and branch finder

-

2.The banks do hardly make use of the capabilities (camera, GPS, ...) of the mobile devices

-

3.The apps are mostly "stand alone" offerings that are not involved in sales and marketing processes

-

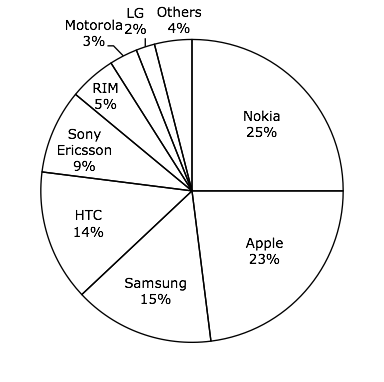

4.Most banks offer only apps for the iPhone and exclude up to two thirds of their customers

I see two reasons for the listed weaknesses.

On the one hand, lack of creativity, ideas and innovation spirit. It thus appears that banks cannot imagine how to offer mobile banking beyond the current online banking.

On the other hand, the banks apparently have not found a solution to cost-efficiently integrate the variety of mobile end devices and operating systems into their IT landscape.

Source: nielsen, German Smartphone Market, Q3 2011

For both, there are solutions.

Open Innovation for mobile financial concepts for the future

A striking example from the world of banking is Commonwealth Bank of Australia, which has launched an open innovation campaign to engage their most creative customers to design the future of the bank.

Commonwealth Bank developed one of the most sophisticated customer touch points strategies across branch, call center, Facebook, online banking, mobile banking and Kaching – a mobile payment service.

Quelle: YouTube, Kaching, Commonwealth Bank of Australia

There are new technologies available to support all mobile devices cost-efficiently

Many of today's IT landscapes of traditional banks are outdated, expensive to maintain and operate, inflexible and have functional gaps. Given the diversity of new mobile devices it is a technical and economic challenge to offer mobile financial applications to all bank customers. Still banks either develop several individual native apps or provide HTML-based solutions. The former is medium to long term not cost efficient, the latter can not exploit the technical capabilities of the various mobile devices, which means that customers do not use these offers.

A technology that has already mastered these challenges is the innovative platform AXS 360° of Market Simplified. AXS 360° is a pure messaging system without a separate data management, which was developed exclusively for the financial industry. Functions from existing applications of the banking IT landscape are normalized and provided specifically for all major mobile operating systems (IOS, OS, Android, Windows). Thus AXS 360° creates for all bank customers native mobile experiences. For the banks, AXS 360° allows medium to long-term cost savings of up to 50% compared to alternative approaches.

Conclusion

A banking app for the iPhone alone does not make a mobile banking strategy of a bank. Using open innovation approaches and new technologies, banks can develop and implement a sustainable mobile banking strategy as part of a comprehensive Customer Touch Point strategy.

Links

http://www.myprivatebanking.com/Report/benchmarking-of-top50-banks-mobile-apps, Benchmarking of Top50-Banks Mobile Apps

http://www.geldinstitute.de/data/news/News-Studie-zu-Banken-Apps_6873303.html, Frankfurt School of Finance & Management

https://www.code-n.org/de, CODE_n12

http://ideas.commbank.com.au, Idea Bank, Commonwealth Bank of Australia

http://www.youtube.com/watch?v=INQmzeFtFtA, Idea Bank, Commonwealth Bank of Australia

http://www.youtube.com/watch?v=gVkBUT0gEsU&feature=relmfu, Commenwealth Bank Kaching, Mobile payments

http://www.marketsimplified.com, AXS 360° innovative IT Platform for mobile financial services